ESG reporting trends 2026, from CSRD reporting in Europe to supply chain due diligence and CBAM compliance, can be summed up in a single business scene that became routine in 2025: a supplier is about to win the contract, until the buyer asks for verified, comparable data on emissions, due diligence, and governance.

Not a slogan. Not a pledge. Evidence. And that is the real shift behind the ESG reset. 2025 didn’t make sustainability easier. It made it auditable, politicized, trade-linked and operational. The question for business entering 2026 is no longer “Do we support sustainability?” It’s far sharper: “Can our sustainability claims survive scrutiny across markets, regulators, and supply chains in a world that is becoming less stable and more demanding at the same time?”

Why 2025 changed ESG: from narrative to infrastructure

For most of the 2010s, sustainability was a fast-rising corporate priority. By 2020–2021 it peaked as mainstream business ideology. Then came the sequence of crises: first energy, then geopolitical, then what some analysts describe as a deeper “values crisis.” That context matters, because it explains why ESG did not simply “grow” in 2025. It hardened.

A global push toward comparable disclosure

In late 2025, ISS-Corporate’s “2025 Sustainability Reporting: Global Trends in Framework Adoption” described how sustainability reporting is maturing beyond voluntary framework selection into a more comparable ecosystem shaped by investor demand and evolving regulation. A telling number: ISS reports that TCFD adoption in the Americas rose from 27% in 2022 to 35% in 2025, a short time window for a major reporting discipline to spread.

The new grammar: ISSB + ESRS

What is changing is not only how much companies disclose, but what kind of disclosure is considered acceptable. For many companies, the real turning point is the rise of ISSB standards, especially IFRS S2, as a global reference point for climate disclosure.

The ESG World Insights report describes the transition from parallel ESG reports toward a single narrative linking sustainability metrics with business strategy, risk, and financial performance, a logic embedded in ISSB globally, and in ESRS under CSRD in the EU. That is a deep shift: ESG reporting is increasingly expected to behave like financial reporting with definitions, governance, traceability, and internal controls.

By the numbers: sustainability is being priced, verified, and stress-tested

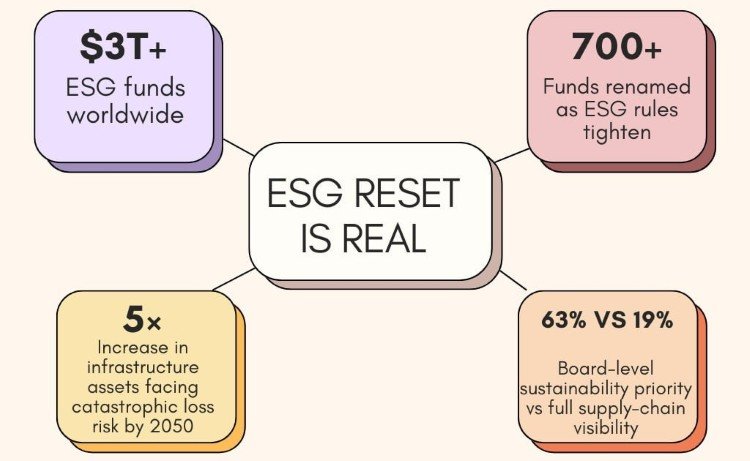

If ESG sometimes feels abstract, the scale of capital and risk shows why it became unavoidable. The market is huge and credibility is tightening: Bloomberg Intelligence notes that ESG funds represent more than $3 trillion in assets, while 700+ funds changed ESG-related names as regulatory expectations tightened. This credibility squeeze is also accelerating demand for ESG assurance, especially where sustainability claims intersect with investor scrutiny and regulatory enforcement.

Sources: European Commission (CBAM); Reuters (EU sustainability law recalibration); Synesgy (Omnibus overview)

Physical climate risk is becoming a balance-sheet issue: MSCI estimates that the share of infrastructure assets facing catastrophic losses (>20%) could increase roughly fivefold by 2050, while insurance premiums linked to physical risk could rise around 50% by 2030. Supply chains are the new ESG bottleneck: Achilles’ survey of 1,600+ companies finds that 63% treat sustainability as a board-level priority, yet only 19% report full visibility across their supply chains. That gap board priority vs. supply chain visibility is the story of ESG in 2026. Companies are being judged not by ambition, but by systems.

The geopolitical and regulatory context: why ESG reporting got harder (and more real)

If the ESG debate feels louder than ever, it’s because ESG reporting is no longer happening in a calm regulatory era. It is happening at the intersection of trade wars, industrial policy, elections, and security logic. This is the real context of 2024–2025: ESG didn’t become less important. It became contested infrastructure.

The United States: backlash, litigation risk, and a compliance patchwork

In 2025 and into 2026, ESG in the United States faced a sharper political and legal pushback. Federal-level climate direction has shifted, and the country’s role in international climate coordination has become more volatile, including moves affecting climate agreements and international initiatives.

But for business, the bigger story is structural: the US is becoming an ESG patchwork where disclosure expectations, regulatory signals, and litigation risks can vary by sector, investor base, and jurisdiction. This has pushed many global companies to adopt a dual strategy keeping ESG reporting robust enough for international investors and supply-chain partners, while tightening language, controls, and substantiation to reduce legal exposure at home.

Bloomberg Intelligence captures this broader dynamic, noting that the US begins to retreat from disclosures while other regions keep advancing in different forms.

Europe: a feasibility reset, not a retreat

Europe remains the world’s densest ESG rulebook but 2025 proved that complexity creates political risk.

The ESG World Insights material describes a late-2025 reality: Europe raised the stakes, yet also entered a phase of political correction, where sustainability reporting requirements became subject to bargaining and simplification pressure.

That creates a new European storyline for 2026: Europe is still setting the baseline but the baseline is being redesigned for feasibility.

China (and wider Asia): sustainability becomes state-directed competitiveness

If the West framed ESG as a mix of investor pressure and regulatory architecture, China increasingly treats sustainability as industrial policy plus competitiveness. China is emerging as a new leader of sustainable development policy, escalating ESG requirements and pushing standards that will likely spill over to importers. It means that suppliers cannot hide behind the logic of Europe doesn’t matter to us anymore.

Across Asia, sustainability reporting is increasingly treated as a capability needed to remain competitive in global supply chains, even if timelines and enforcement differ.

What will actually change inside ESG reporting in 2026

For many companies, 2026 will feel less like “a new report” and more like “a new operating requirement.” The most practical shifts are already visible.

First, reporting is becoming more comparable across jurisdictions as companies align to ISSB (especially IFRS S2) and, where relevant, ESRS under CSRD.

Second, Scope 3 reporting is moving from aspirational to expected. Even when estimates are still necessary, buyers and regulators increasingly want clarity on boundaries, data sources, and improvement plans.

Third, ESG assurance is moving from a niche add-on to a credibility filter. As markets tighten around greenwashing risk, assurance readiness begins to shape how sustainability teams collect data, how finance teams document controls, and how boards govern material decisions.

Finally, supply chain due diligence is becoming a data discipline. Procurement, compliance, sustainability, and risk teams are being pushed into the same room because ESG performance is now measured in suppliers, subcontractors, and logistics flows, not only in headquarters policies.

The enabling conditions: what makes sustainable business actually work

The ESG reset is forcing companies to stop treating sustainability as an overlay and start treating it as an operating system.

Three enabling conditions now separate sustainable business leaders from sustainability storytellers.

Condition A: Reporting architecture that works across markets

In 2026, the best companies will not build one report per jurisdiction. They will build one internal truth system and export to different formats.

This is where ISSB interoperability becomes strategic, and ESRS becomes unavoidable for European exposure.

Condition B: Reliable data and defensible assumptions

The gray zone is shrinking: weak data isn’t merely imperfect. It becomes a legal, reputational, or procurement risk.

Condition C: Supply chain due diligence becomes the ESG stress test

The Achilles data point is the warning light: only 19% full supply chain visibility, even while boards prioritize sustainability.

This is why ESG is moving from annual narratives to operational controls. In 2026, supply chain due diligence is no longer best practice. It is becoming baseline compliance for doing business.

Europe as the global test case: reporting, simplification and carbon trade rules

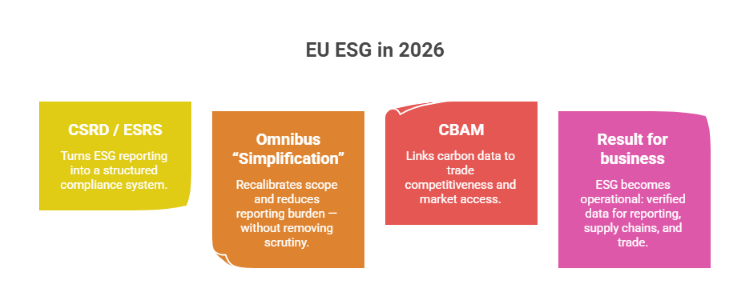

Europe remains the world’s most important laboratory for sustainability regulation because European requirements increasingly shape global supply chains.

In December 2025 the EU agreed to weaken parts of its corporate sustainability laws, narrowing scope and focusing obligations on larger firms. Reuters reported the changes would reduce coverage from around 50,000 companies, with CSRD applying above 1,000 employees and €450 million in turnover, while due diligence obligations would apply above 5,000 employees and €1.5 billion in turnover. At the same time, simplified doesn’t mean toothless: penalties can still reach 3% of global turnover.

This recalibration was framed not as a retreat, but as a feasibility reset. The 9 December 2025 agreement was presented under the first Omnibus package aimed at simplifying overlapping sustainability reporting and due diligence requirements.

CBAM: when carbon reporting becomes trade infrastructure

The European Commission confirms that CBAM entered into force on 1 January 2026, tying carbon transparency directly to cross-border competitiveness.

A real-world moment: for many exporters, CBAM will surface in the most practical way possible as a question from a European customer or importer: “What is the verified carbon footprint of this shipment, and can you document it?”

For exporters, CBAM compliance is quickly becoming a commercial requirement, not just a sustainability exercise.

A new global carbon accounting signal: ICC + Carbon Measures

CBAM is one driver. But it is not the only one. In early 2026, the International Chamber of Commerce (ICC) and the Carbon Measures coalition announced an expert panel tasked with developing a global carbon accounting framework to track emissions at the product level across value chains, defining its principles, scope and real-world applications.

This is a quiet but powerful signal of where ESG reporting is going: toward product-level, chain-level, decision-ready carbon information.

The gray zones: when geopolitics reshapes what ESG means

The ESG gray zones are expanding because ESG is now forced to operate inside conflicting priorities: competitiveness, security, and trade.

That reshapes corporate reality in three ways:

- Disclosure becomes litigation-sensitive. Weak numbers are not just embarrassing. They can become liabilities.

- Supply chains become political. A supplier risk can be environmental, geopolitical, or reputational — often simultaneously.

- Capital becomes conditional. Not every investor agrees on what counts as sustainable, but most agree on what counts as defensible.

The practical solution isn’t to chase a perfect narrative. It is to build decision-making systems that survive scrutiny.

The 7-move playbook for sustainable business in 2026

Here is a practical roadmap for leaders building sustainability that survives volatility and scales across regions:

- Build a single source of truth for ESG data. If your numbers can’t be reconciled quickly, they won’t survive verification.

- Choose reporting standards for interoperability. Build one core system that outputs to multiple requirements.

- Make assurance readiness a core capability. Audit-like expectations are rising; prepare early, not at the deadline.

- Turn supply chain due diligence into a system, not a questionnaire. Monitoring, escalation, and remediation are embedded into procurement workflows.

- Put sustainability governance in the boardroom. Define ownership, materiality, incentives, and internal controls.

- Plan for Europe’s evolving rulebook and carbon trade reality. Expect adjustments to the reporting scope, as well as trade-driven pressure for carbon transparency via CBAM.

- Communicate trade-offs clearly, with evidence. In a polarized world, credibility comes from clarity, not perfection.

Sustainable business is not a label. It is a capability

The real story of 2025 is not that ESG won. It’s that ESG entered a more difficult phase: verification, enforcement, and geopolitics.

That is why the most useful way to think about ESG reporting trends 2026 is not as a reporting checklist, but as a business capability: the ability to produce credible, comparable, decision-ready sustainability data and to use it under pressure.

Mini-FAQ (quick answers)

What are the key ESG reporting trends 2026?

Interoperable standards, verification discipline, tighter supply chain scrutiny, and rising trade-linked carbon transparency.

What is CBAM — and why does it matter for business?

CBAM is the Carbon Border Adjustment Mechanism. It links carbon emissions to cross-border trade competitiveness and entered into force on 1 January 2026. The CBAM mechanism itself (and its evolving design) is explained here.

Is ESG ending because of politics?

No. But it is fragmenting. The center of gravity shifts between regions, yet global supply chains still demand auditable sustainability data.